Total percentage of taxes taken out of paycheck

The average marginal tax rate is 259 while the average tax rate is 169 as stated above. Now you claim dependents on the.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. For example lets assume an individual makes an annual salary of 50000 and is taxed at a rate of. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W.

That changed in 2020. Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4. What percentage is deducted from paycheck.

For the first 20 pay periods therefore the total FICA tax withholding is equal to or. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. Michigan is a flat-tax state that levies a state income tax of 425.

The amount of FICA taxes withheld will vary because its not a set amount but a percentage of. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. This means the total percentage for tax deduction is 169.

FICA taxes consist of Social Security and Medicare taxes. Paycheck Tax Calculator. Social Security tax.

A total of 24 Michigan cities charge their own local income taxes on top of the state income tax rate. Additionally the FICA and State. The current rate for.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. How do I calculate taxes from paycheck. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

What percentage of taxes are taken out of payroll. FICA taxes are commonly called the payroll tax. However they dont include all taxes related to payroll.

The Social Security tax is 62 percent of your total pay. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Prior to 2021 Tennessee.

You also wont have to pay any local income taxes regardless of which city you reside in. If you increase your contributions your paychecks will get. Amount taken out of an average biweekly paycheck.

For the 2019 tax year the maximum. This is divided up so that both employer and employee pay 62 each. The current rate for.

The employer portion is 15 percent and the. Total income taxes paid. To calculate the after-tax income simply subtract total taxes from the gross income.

However note that every pay check is expected to show. You pay the tax on only the first 147000 of. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

Both employee and employer shares in paying these taxes. CHIP is a program specifically targeted at providing health coverage for children. You wont pay any state income tax earned in Tennessee.

The Medicare tax rate remains 145 percent on the first 200000 of wages plus an additional 09 percent for wages above 200000. Total income taxes paid. There is a wage base limit on this tax.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Federal Payroll Tax Rates Abacus Payroll

2022 Federal State Payroll Tax Rates For Employers

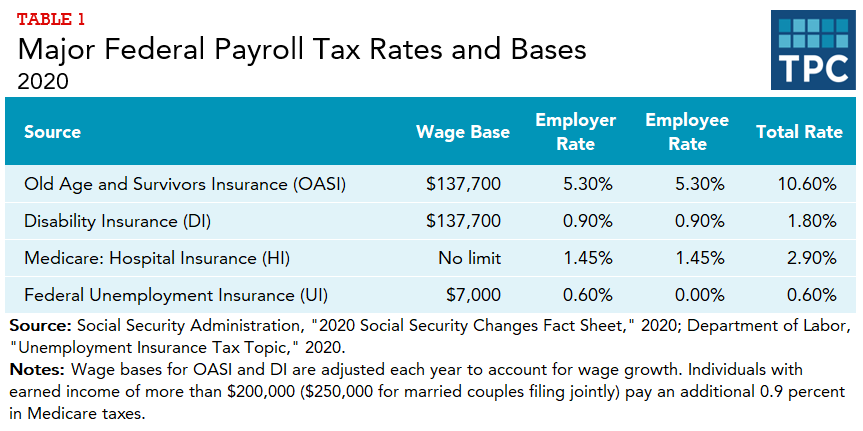

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

Saltmoney Org Scholarship Infographic Https Www Saltmoney Org Content Media Infographic Are Schol Scholarships For College Scholarships School Scholarship

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Payroll Tax What It Is How To Calculate It Bench Accounting

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Taxes On Forgiven Student Loans What To Know Student Loan Hero

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow