35+ Credit card debt pay off calculator

Always pay your bill on time. Credit card issuers tend to set minimum payment requirements at rock-bottom levels.

How To Save Money With Your Boyfriend Random Assets Of Life Saving Money Couple Finances Financial Planning Dave Ramsey

A monthly bill as small as a streaming service payment can keep your account open and reflect positively in your credit.

. In addition to our debt management program our community outreach team DBA. A lower rate can help you save money each month in interest. While you would incur 2127 in interest charges during that time you could avoid much of this extra cost and pay off your debt faster by using a 0 APR balance transfer credit card.

Make a single monthly payment to pay off several debts. This could be ideal for people with good or excellent credit who qualify for the card and expect to pay off their balance within the intro APR period. It is fine-tuned to predict the risk of defaulting specifically on credit card payments.

Using a loan to consolidate credit card debt may be a good idea if the interest rate on the loan is lower than your current credit card rates. 3599 APR and terms from 24 to 60 months. There is usually a dollar amount for your minimum monthly payment also so it may be expressed as something like 35 or 2 of your balance plus fees whichever is greater.

FICO likes you to use 30 or less of the available credit. Use WalletHubs credit card minimum payment calculator to find out how long it would take to pay off your debt by just paying the minimum amount due each month. Credit card payoff calculator.

And its one of the main things that creditors look at. By taking the proceeds of a personal loan to pay off credit card debt you can eliminate multiple monthly high-interest card. Your report card shows your grade total late payments and more.

Second mortgages come in two main forms home equity loans and home equity lines of credit. The application and. That said the interest.

Balance Transfer Calculator. Use your credit card regularly. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

If you have a 1000 limit on your credit card that means limiting spending to less than 300 a month. Youll generally owe either a fixed amount often 25 or a percentage of the balance whichevers greater. 35 of score Amounts owed 30 of score.

For those having trouble with credit card debt talking to a credit counselor and getting on a debt management plan DMP could be a good option. Its always a good idea to pay off credit card debt regardless of how that. In general however you could see an improvement in your credit as soon as one or two months after you pay off the debt.

Use a debt consolidation calculator to understand how much you can potentially save by. Credit card payoff calculator. Youll need to pay off each credit card with the money deposited to your bank.

Located in San Diego our customer-service oriented team has helped more than 1 million people in 46 states plus Washington DC pay off more than 7 million worth of credit card debt since 2001. 4292 Find the credit card thats right for you Its quick free and easy. Like the Auto Score the FICO Bankcard Score uses a score range of 250 to 900 with higher scores indicating lower risk.

Revolving Accounts Credit Cards A credit card is a form of revolving credit meaning money can be re-borrowed as its paid back and theres no end term. Credit history is the third factor counting for 15. Line of credit calculator.

If you are paying interest on an overdraft personal loan or other debt paying it off with a 0 money transfer credit card can eradicate the interest you pay and help you become debt-free quicker. Regularly using your credit card demonstrates your ability to manage debt well and ensures the account isnt closed due to lack of use. So if you owe 2000 your minimum payment might be 40.

What are some pros and cons of getting a personal loan to consolidate debt. Free credit card calculator to find the time it will take to pay off a balance or the amount necessary to pay it off within a certain time frame. The San Diego Financial Literacy Center provides free educational.

Heres what to expect as you pay off debt. If you need more time to pay off your debt consolidating your credit card debt into a personal loan may offer lower interest rates over a longer period of time. To pay off the credit card in full during the 0 introductory period each month youd need to pay.

Your payment history makes up 35. The FICO Bankcard Score is another industry-specific variation on the FICO Score customized for use by credit card issuers. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Typically the minimum payment is a percentage of your total current balance plus any interest you owe. Average about 8-12 though it is possible for someone with excellent credit to get even lower rates. In addition a personal loan to pay off credit card debt often comes with fixed rates predictable monthly payments and a known payoff date.

Credit Card Payoff Calculator. The minimum payment on a credit card is the smallest amount you can pay to keep your account in good standing. Payoff is specifically designed for borrowers who want to pay off their credit card debt.

A Beginners Guide. Keep in mind that. Credit card debt credit limit and how different factors affect your score.

The longer you own a credit card the more it improves your score provided you pay it off every month. Payment history makes up 35 of your credit scorethe biggest part. Pay Down Revolving Account Balances.

The counselor may be able to negotiate lower payments and interest rates and get card issuers to bring your accounts current. Second mortgage types Lump sum. What is a loan for debt consolidation.

Among users of buy now pay later services there was a fairly even split when it came to trusting buy now pay later services and credit card companies with personal data 29 versus 22. A debt consolidation loan combines many unsecured debts into a single fixed monthly payment including credit cards medical bills and payday loans. In order to pay off 7000 in credit card debt within 36 months you need to pay 254 per month assuming an APR of 18.

This is because credit card debt is unsecured meaning there is no collateral backing. Helping you pay off your credit card debt without racking up even more interest charges. Often 25 to 35 when you enroll in a DMP.

Payment history is the record of whenand ifyou pay your bills.

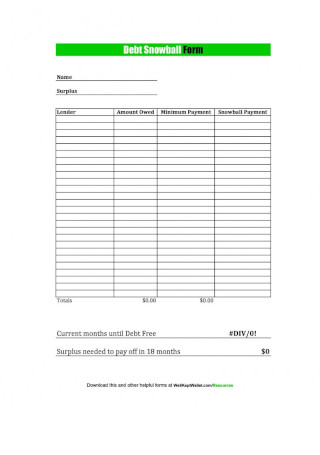

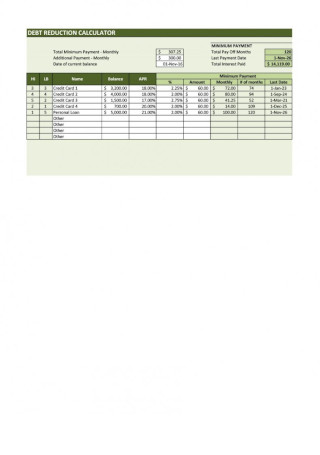

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Pin On Budgeting Tips

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

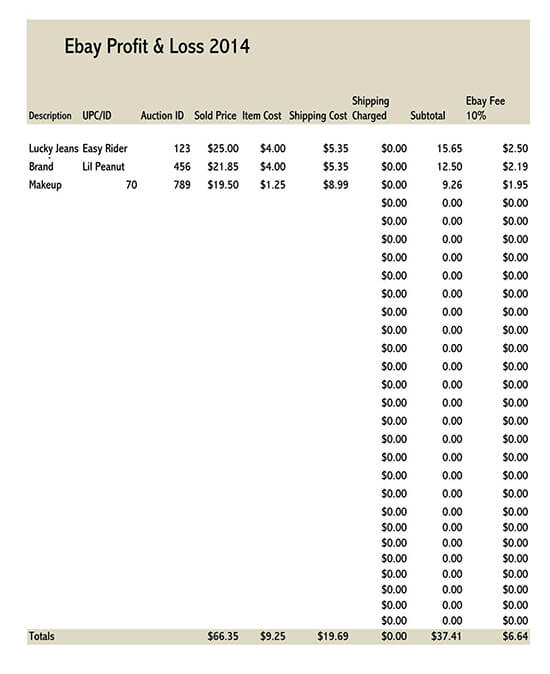

Free Profit And Loss Income Statement Templates Excel Word

Deals On Twitter Planejamento Financeiro Objetivos Financeiros Lista De Convidados De Casamento

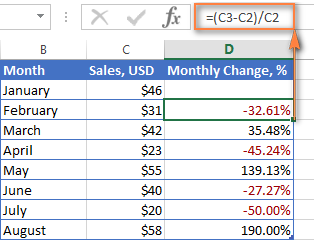

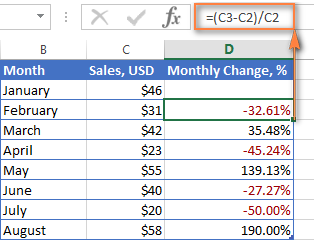

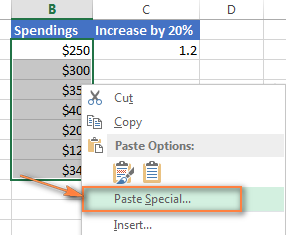

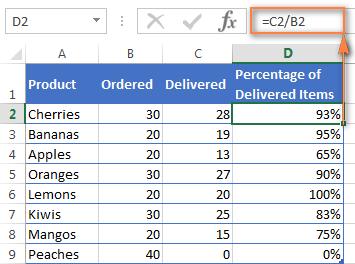

How To Calculate Percentage In Excel Percent Formula Examples

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

What Is An Expense Ratio You Ll Want To Know Believe Me

45 Best Startup Budget Templates Free Business Legal Templates

How To Calculate Percentage In Excel Percent Formula Examples

How To Calculate Percentage In Excel Percent Formula Examples

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Yet Another Reason To Adopt Devops Pandemic Proofing Your Team

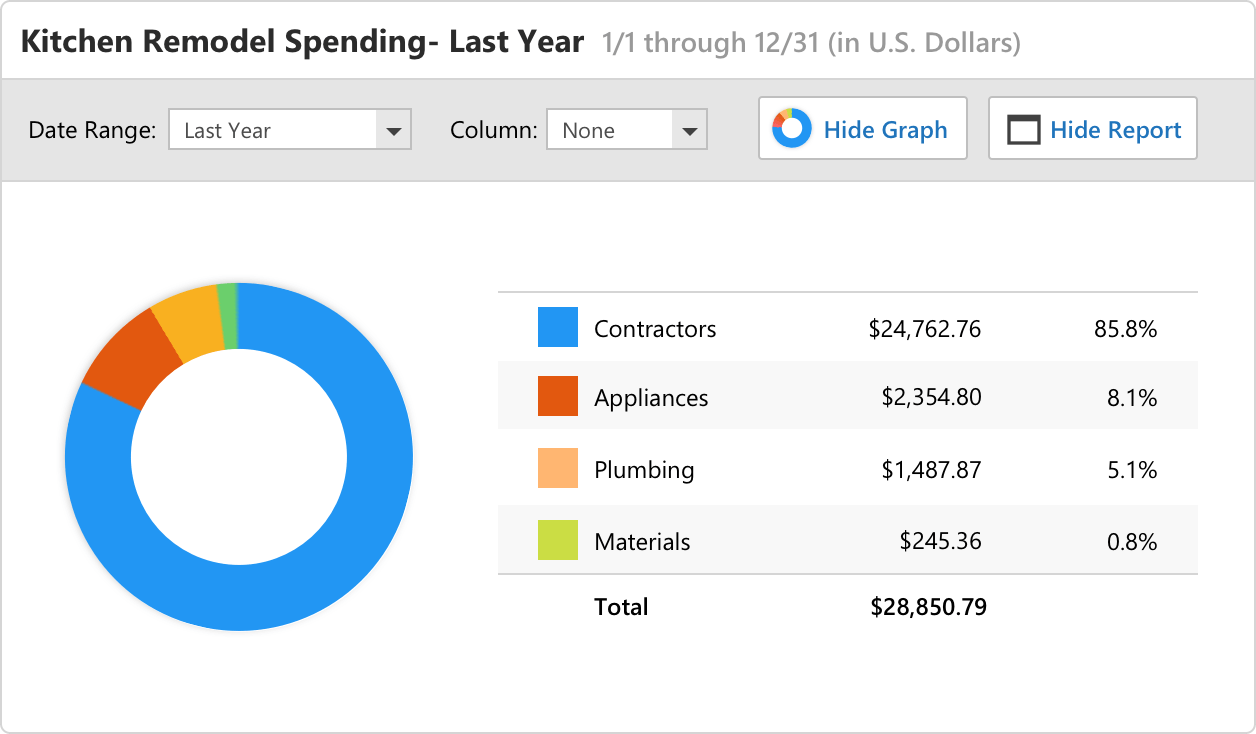

Quicken Starter

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word