Tax asset depreciation calculator

Section 179 deduction dollar limits. By using the formula for the straight-line method the annual depreciation is calculated as.

Depreciation Formula Calculate Depreciation Expense

Where Di is the depreciation in year i.

. Calculate depreciation for a business asset using either the diminishing. Looking at the depreciation table in Publication 946 the rate shows as 1819 for an asset placed into service in the 4th month which would give you 2547 in depreciation. Depreciation Calculator Pro has been fully updated to comply with the changes made by the Tax Cuts and Jobs Act TCJA legislation that affect the calculation of fixed asset.

This means the van depreciates at a rate of. Depreciation - Life of Asset. 35000 - 10000 5 5000.

Depreciation can be claimed at lower rate as per income tax act. Block of assets Rate of depreciation 5. D i C R i.

This limit is reduced by the amount by which the cost of. You can use this tool to. Written down value on the first day of previous year.

Depreciation not refigured for the AMT. C is the original purchase price or basis of an asset. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed.

The tool includes updates to. First one can choose the straight line method of. To determine the classification of property being depreciated whether it is 3-year property 5-year property etc refer to IRS Instructions for Form 4562.

PPF Maximum Withdrawal Calculator. Depreciation Calculator has been fully updated to comply with the changes made. Ad Fixed Asset Pro Is Continually Updated For The Latest Changes In Tax Depreciation Rules.

Our FREE on-line Depreciation Calculator goes through the same process as we do when clients phone for depreciation estimates. Depreciation Calculator as per Companies. The depreciation rate stays the same throughout the life of the asset used in this calculator.

All-In-One System For Fixed Asset Depreciation Accounting Management And Reporting. See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. It will take just a few minutes to enter the information.

Depreciation Calculator As Per Income Tax Act. Depreciation calculations are made for both regular tax and alternative minimum tax AMT purposes. The MACRS Depreciation Calculator uses the following basic formula.

Depreciation Calculator Companies Act 2013. For eg if an. Qualified Asset - if your asset is a qualified asset select the special allowance including the new 100 bonus depreciation.

Find the depreciation rate for a business asset. Before you use this tool. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

It provides a couple different methods of depreciation. There are four main methods to account for depreciation. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

Except for qualified property eligible for the special depreciation allowance. Addition for a period of 180 days or more in the previous. Ad Learn More About American Funds Objective-Based Approach to Investing.

Rental Income Calculator Calculate ROI return-on-investment. This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciation rate finder and calculator.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Dont refigure depreciation for the AMT for the.

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Calculator Depreciation Of An Asset Car Property

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

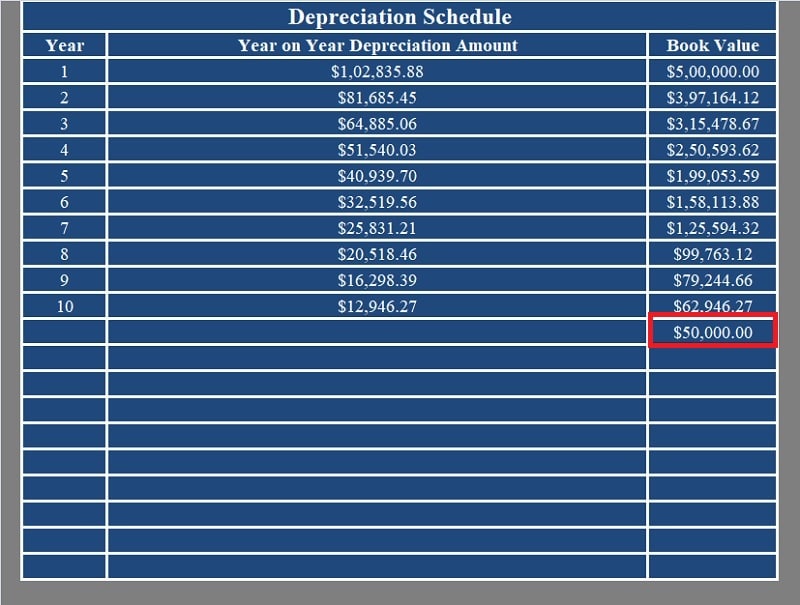

Depreciation Schedule Formula And Calculator Excel Template

Asset Depreciation Schedule Calculator Template

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Calculate Depreciation Expense

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Macrs Youtube

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

1 Free Straight Line Depreciation Calculator Embroker